- Home

- Success stories

- Starlink Energy

About the solution

PixelPlex created a project for the USDC lending platform. It is a non-custodial platform that offers users predictable fixed-yield earnings on USDC deposits. The concept prioritizes future growth while optimizing the client's initial development budget.

Details

Date:

2025

Timeline:

3 weeks

Team

Business Analyst

UI/UX Designer

Technical Lead

Project Manager

Solidity Developer

Project goals and solutions

Our primary objective was to deliver a solution that would become a cornerstone of the Canton ecosystem. We focused on three key goals:

Develop an MVP

Validate the demand among crypto holders for a simple, secure, and compliant way to earn predictable passive income on stablecoins.

How we achieved it?

Provide investors with predictable returns

There’s a demand for stable yield-generating opportunities in the cryptocurrency market. Most products expose users to high volatility and complex risks.

How we achieved it?

Ensure full transparency, security, and compliance

The current market demonstrates a clear gap for stable, user-friendly lending solutions that would offer enterprise-level compliance and security.

How we achieved it?

Automate workflows

Without automation, the platform cannot provide the reliability or seamless experience required to compete effectively

How we achieved it?

Potential benefits of a USDC lending platform

Fast User Vetting

200% faster user verification through the seamless KYC integration.

Saved Dev Hours

200+ development hours saved with the Reown integration (WalletConnect).

Automated Fund Flow

Staff optimization due to automated fund allocation without manual intervention.

Have an idea?

Work done

Product vision and requirements

Conducted discovery, analyzed business risks, outlined objectives, and mapped out the architecture for both on-chain and off-chain components.

Core functionality determination

Developed user flows, lending logic, KYC process, wallet integration, and admin functionality, ensuring compliance and usability.

Design structure

Mapped the high-level architecture, detailing the interaction between on-chain smart contracts and off-chain backend components.

Technical solution

Proposed smart-contract design with fixed-rate pools and LiquidityGuard, backend orchestration with Circle API, and frontend modules for investors and admins.

Smooth implementation

Documented the full stack (frontend, backend, smart contracts, integrations) and ensured alignment with security, transparency, and compliance standards.

Key features

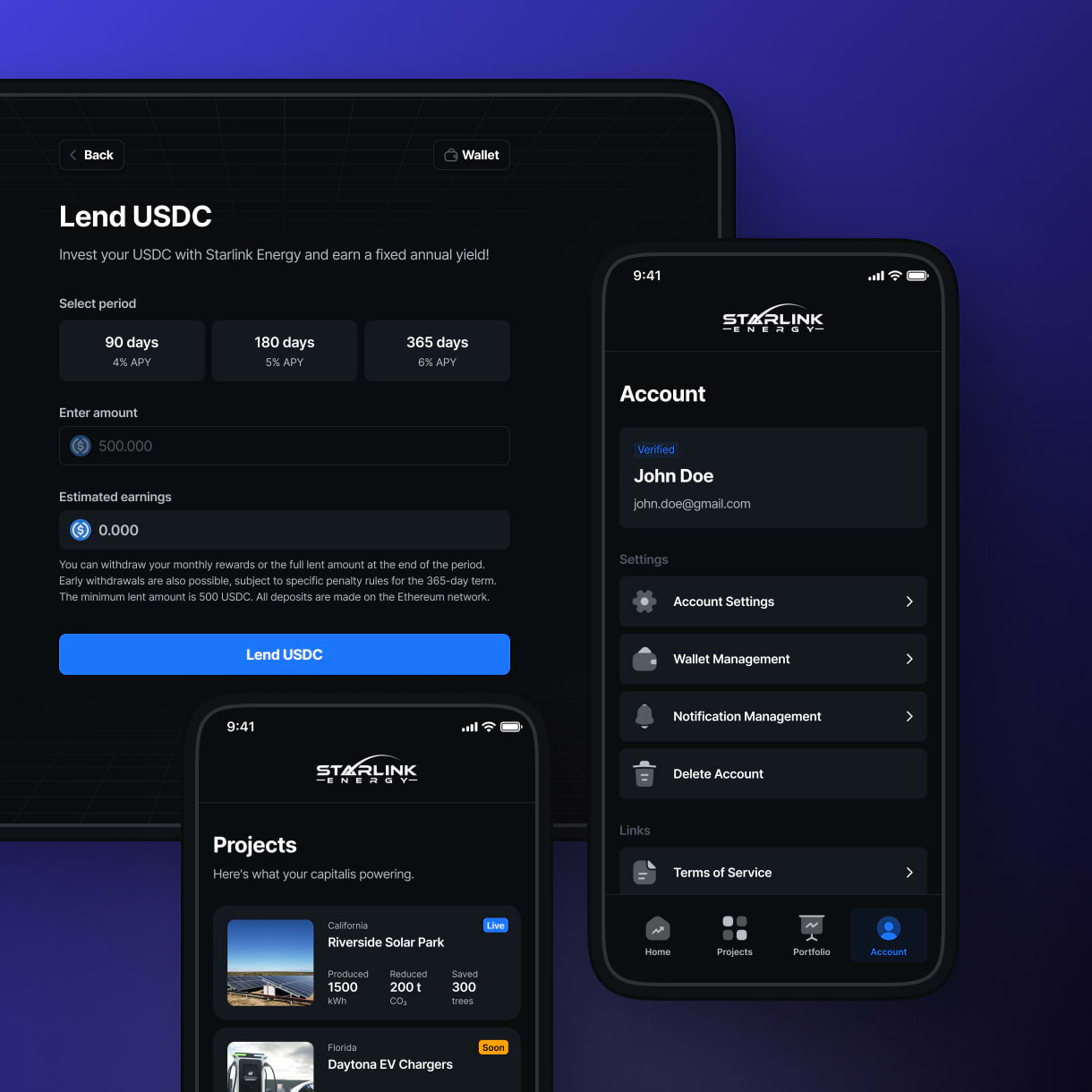

The Starlink Energy application is accessible for both desktop and mobile browsers. An administrative web panel allows for analytics and smart-contract management, while investors may connect a wallet to lend USDC and manage their investments.

Fixed-term lending pools

Users choose from 90, 180, or 360-day pools with fixed APY for predictable returns.

KYC verification

The integrated SumSub SDK ensures compliant and secure identity verification for platform access.

Wallet integration

Investors connect their EVM wallets via Reown to manage deposits and view on-chain balances.

Portfolio dashboard

An intuitive interface shows active deposits, accrued rewards, and transaction history.

Early withdrawal option

Users may exit early under fixed rules, balancing flexibility with stability through penalties.

Transaction history

A consolidated log of all activity with direct Etherscan links provides full transparency.

LiquidityGuard mechanism

This automated system maintains a sufficient liquidity reserve to guarantee all investor payouts.

Admin console

Operators use this console for analytics, user management, and liquidity forecasting.

Circle API integration

The API automates liquidity top-ups and payouts to ensure transparent fund flows.

Notifications & compliance tools

These integrated tools, including SendGrid for emails, help admins maintain regulatory compliance.

Want to check a case similar to yours?

Our process

Discovery and risk assessment

- Analyze business objectives, user needs, and identify key regulatory, market, and technical risks.

Technical blueprint

- Define the high-level architecture, specifying the interaction between smart contracts, backend, and frontend.

Defining MVP

- Prioritize and detail the features for the MVP, focusing on core lending functionality.

Smart contract planning

- Design the core lending logic, including pool mechanics, reward distribution, and security models.

Integration strategy

- Outline the development strategy for frontend and backend components and their connection to the blockchain.

Scalable roadmap

- Create a phased implementation plan that ensures a robust MVP while preparing for future network expansion and feature growth.

Technologies and architecture

NextJS

React

TypeScript

Reown

NestJS

PostgreSQL

Redis

Docker

Solidity

Circle API

SendGrid

SumSub

Frontend

Backend

Blockchain

Smart contracts

Database

Integrations

Services

We offer a comprehensive range of services, including IT consulting, custom software development, and specialized expertise in blockchain, machine learning, and data science.

Blockchain Development

Blockchain Development

Smart Contract Development

Web3 Development

Crypto Payment Solutions

Tokenization Services

Protocols

Protocols

Cryptocurrency Exchange Development

Cryptocurrency Development

Top Development Company

Blockchain Consulting

Top Blockchain Consulting Company

Custom Software Development

Custom Software Development

Mobile App Development

Web Development

Top IT Services Company

IT Consulting

Top Consulting Company

ML Development

Artificial Intelligence Development

Machine Learning Development

Data Science Development

Top BI & Big Data Company

AR & VR Development

AR & VR Development

QA & Software TestingQA & Software Testing Services

UI/UX DesignGive us the pleasure of adding our secret sauce to your app.

We’ll create beautiful screens at the front while breaking the limits of what’s behind them to help your app get to beyond-plausible business achievements.

UI/UX Design Services

MVP DevelopmentValidate your product idea quickly with an MVP—launch faster, test smarter, and refine based on real user feedback.

Leverage our expertise in MVP development to build a scalable, market-ready product with minimal risk and maximum efficiency.

MVP Development Services

Metaverse Consulting & DevelopmentValidate your immersive concept quickly with metaverse development — launch your virtual experience, gather actionable user insights on core features like avatars and social interaction, and iterate based on real-world engagement.

Top Development Company

Solutions

RWA PlatformTokenization makes it easier to trade assets and opens up new investment opportunities and diversifies portfolio.

RWA Platform

Asset tokenization platform development

Arbitrage BotProfit from market inefficiencies with automated, customized trading strategies that boost returns and minimize risk.

Arbitrage Bot

Be a transaction ahead. Catch profit at short notice

CryptoAPIGain an unfair data edge for your dApps. Tap into high-quality blockchain insights to outsmart competitors and fuel smarter decisions.

CryptoAPI

Connect your dApps to blockchain networks in a flash

OTC HawkOffer high-net-worth clients a secure, enterprise-grade trading terminal. Streamline deals, enhance reliability, and optimize top-tier crypto assets.

OTC Hawk

Benefit from our portfolio and wealth management app

DocFlowManage sensitive documents on blockchain. Leverage optional zero-knowledge proofs for trust, privacy, and streamlined workflows.

DocFlow

Intuitive Blockchain-Powered Document Management System

Know-Your-TransactionEnsure every transaction is above board. Monitor digital asset flows for compliance and transparency, supporting both businesses and regulators.

KYT crypto platform

Our KYT platform fosters integrity of financial ecosystems

Industries

We work across a variety of industries, from FinTech to eCommerce, leveraging our accumulated knowledge and best practices to deliver solutions tailored to the unique needs of your business.

FinTech & BankingAs traditional finance goes digital, we are committed to building efficient ecosystems and better engagement.

Think of customized FinTech solutions with tamper-proof transactions and storage, progress transparency and automation — and we’ll make them see the light of day.

$25T

Global Financial Services

20%

Digital/Blockchain Growth

Solutions for FinTech & Banking

Retail & eCommerceWhether you market B2B or B2C, commerce tech trends are all about value-driven purposes, global sustainability, hybrid shopping journeys, and extra-resiliency.

Let your clients know that there’s more to your brand than meets the eye by creating unique customer experiences in all your stores.

$6.3T

Global eCommerce

10-15%

Tech Innovation Growth

Solutions for Retail & eCommerce

Supply Chain & LogisticsTo make things easier for all vendors, we deliver apps for route and cost optimization, vehicle operational support, and better dispatch time efficiency.

With focus is sustainability, resilience, transparency, and immutability, let’s get your transformation going.

$10T

Global Logistics

15-20%

Blockchain Adoption Growth

Solutions for Supply Chain & Logistics

HealthcareCustom healthcare software solutions are aimed at helping you ensure accurate diagnosis, better patient engagement, and positive healthcare outcomes.

Whether you require a patient management solution, practice management software, EMR/EHR system, or ML-enabled diagnostics – we’ve got you covered.

$10T

Global Healthcare

20%

Digital/Blockchain Growth

Solutions for Healthcare

Real EstateKeep up with digital innovation trends by accelerating enterprise transformation and scaling, leveraging data and orchestrating workflows.

Whether you manage and sell commercial facilities or invest third-party capital, our integrated solutions help you make the most of it.

$340T

Global Real Estate

15%

PropTech/Blockchain Growth

Solutions for Real Estate

Oil & GasWith mobility and digital technologies standing to change the game and define leadership, our mission is to get you digital-first.

Resolve operational and conceptual issues by introducing clear tech vision, feasible architectures, and flexible software to take business extension off limits.

$4T

Global Oil & Gas Industry

10-15%

Digital/Blockchain Growth

Solutions for Oil & Gas Industry

InsuranceImagine a world where quoting policies, processing claims, and managing mountains of paperwork are effortless. PixelPlex can help you achieve just that.

Break free from outdated systems and focus on what truly matters – delivering exceptional service to your policyholders and growing your insurance business.

$25T

Global financial services

20%

Digital/blockchain growth

Solutions for Insurance Industry

FitnessWe create custom fitness software solutions that support meaningful training and steady engagement from the first session.

If you’re building a digital product for active users and need a team with real project experience behind it, we’ll help you bring it to life with clarity and purpose.

$257B

Global Fitness Industry

24%

Digital Growth

Solutions for Fitness

BankingFinancial systems face continuous change and ongoing scrutiny throughout their lifecycle as products evolve.

Our solutions are designed to stay predictable under regulatory oversight and daily operational load, helping teams build systems they can rely on.

$191T

Global Bank Assets

62%

Digital Payments Use

Solutions for Banking

RestaurantCustom restaurant management software allows for reducing costs, smooth internal CRM and delivery systems integration, and easy scalability.

We develop restaurant ecosystems that turn your complex business data into actionable insights that the whole team can understand and use.

$4.2T

Global Food Service Market Value

+7.2%

Annual Growth Rate

Solutions for Restaurant

Success stories

Domain

Industry

Protocols

Company

About us Team Careers Social Responsibility ContactsBlog

Blockchain Big Data Artificial Intelligence AR/VR Mobile News View Blog